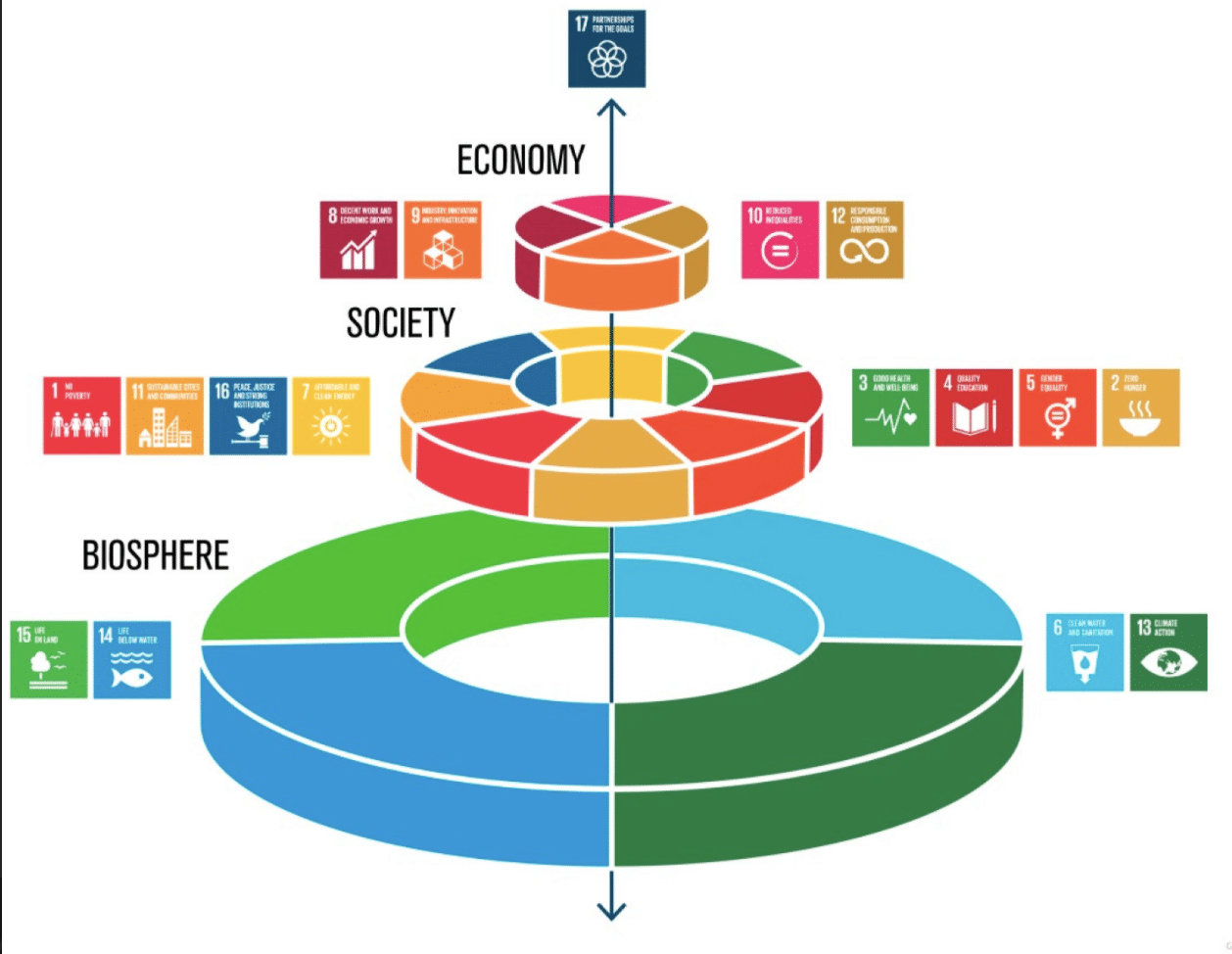

The United Nations Sustainable Development Goals represent the leading framework for environment, social and governance (ESG) guidance in many large companies around the world. Many associations, institutes and trade organizations have emerged to help specific industries set detailed criteria for ESG in vertical markets. Individual companies and their investors also devise their own standards for operations and potential investments.

Institutional investors and other large asset managers have emerged as important influencers in this arena. For example, index fund providers such as BlackRock, State Street and Vanguard have exerted their influence on sustainable investing trends. Their influence stems from the fact that each institution holds an average of more than 20 percent of each company in the S&P 500. In addition, the shares they own add up to about 25 percent of all shares voted in corporate elections.

Nuclear energy advocates have been making slow progress to include this technology in the clean energy portfolios of socially conscious investors. The Vanguard Index still maintains a specific exclusion of nuclear energy. IP3’s created Allied Nuclear to produce a comprehensive approach to the nuclear energy ecosystem that produces adjacent benefits in terms of job creation, workforce development, national security and industrial strategy. This integrated model for energy development fits into a wide array of goals set by impact investors and provides greater foresight into a country’s long-term investment context.